Join me on a dual journey of maximising free cash obtained from cashback offers, such as cashback websites and banking sign up bonuses, and then taking that free cash tand growing it even further by trading on the stock market using the fee free trading apps Freetrade and Trading 212.

I intend to keep this blog fairly up to date with my transactions each week so please keep coming back.

Fee free trading apps such as Freetrade and Trading 212 lend themselves to trading in small amounts due to their lack of fees as well as allowing higher frequency trading so I thought it would be interesting to actually see how much it is possible to grow the free cash by trading on a mixture of shares that have caught my eye and discussed in other articles in this blog, as well as trading on a few opportunities that I have not had time to research fully or those for which which I am not certain of the risk-reward potential but think worth a shot since I am trading with free cash.

I am hoping trading with free cash will also remove some nervousness to trade that you get when you have more skin in the game so it will also be interesting to see how this portfolio performs against my more risk adverse portfolio.

To find out more about the Freetrade app then take a look at this article.

I have only just started using the Trading 212 app, having found out about it since my article on Freetrade, initally it appears more feature rich, with features such as fractional share trading already available, and also with lower fees such as on it's ISA account, so potentially Trading 212 could be the more favourable platform! I will try and write an article on it soon, but in the meantime if you use the following referral link we will both get a free share worth up to £100.

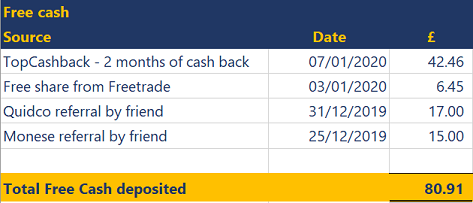

So far I have received £80.91 of free cash in the space of a couple of months, find out more below:

7/1/2010: Received £42.46 from Topcashback website on cashback from about two months of online purchases! Find out more in this article. Or use the following referral link and currently we both receive £7.50 if you sign up and earn £10 of other cashback!

3/1/2020: Received £6.45 from Freetrade and invested by Freetrade in a Pearson share for referring a friend to Freetrade. Email me at following link and if I have a referral invite available I will pass it on if you are serious about setting up an account: leon@evolving.money

31/12/2019: Received £17 for being referred to Quidco cashback website. Find out more in this article. Or use the following referral link and currently we both receive £10 if you sign up and earn £5 of other cashback!

25/12/2019: Received £15 for being referred to Monese challenger bank account. Find out more in this article. Or use this following referral link and currently we both receive £20 if you sign up to Monese!

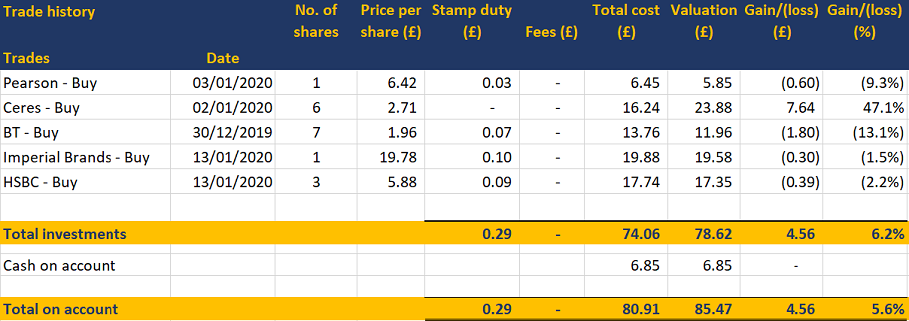

Performance: Invested funds are now up 6.2% in less than a month! This is soley due to the impressive performance of Ceres Power with it's continuing momentum gains in its share price, whilst other investments have so far seen falls but early days so hopefully nothing to worry about yet.

Trades:

13/1/2020: Bought 1 share in Imperial Brands at a cost of £19.88. Although longer term I would be wary of prospects for the tobacco industry given the regulatory environment, I think the risks have been over reflected in the share price, trading on P/E of 6 and so below the ten year average of 19.1x. I think the current valuation could potentially be a floor supported by the dividend, so might be worth a small punt to see if there is any upside in the coming months.

13/1/2020: Bought 3 shares in HSBC at a cost of £17.74.HSBC's share price, being down almost 25% over two years, has been impacted by the protests in HK, Brexit and the US-China trade war. On a P/E ratio of 12, dividend yield of 6% and with interim CEO Noel Quinn slashing costs and reallocating capital to higher growth Asia, I think the price correction is over done and so risk is hopefully to the upside.

3/1/2020: Freetrade allocated a free share in Pearson for referring a friend. I don't know too much about the company, but appears to be near 10 year lows and going through a restructure to simplify the business so appears to be a contrarian play that is potentially worth a gamble so I have retained…

2/1/2020: Bought 6 shares in Ceres Power at a cost of £16.24. There seems to be some strong momentum on this share, tapping into the carbon neutral theme, possibly overinflated price, but will try and ride the momentum for a while.

30/12/2019: Bought 7 shares in BT at a cost of £13.76. After the election result, risks of nationalisation has fallen away, with 7%+ dividend yield I think BT should still appreciate further from price at time of my article.