A lot of people have a dream of building a property empire but at the start are daunted by the stresses of choosing a property, finding enough funds to put a deposit down, dealing with, finding and then placating tenants etc. It does not help also that the government have made it a lot less tax efficient to own second properties directly, reducing the tax deductibility of mortgage interest and hiking stamp duty. But on the other end of the spectrum investing into a property fund is so far removed that most of the excitement of investing into property has been removed.

There is however a middle ground of online property crowdfunding platforms, such as Property Partner, whereby you can invest in smaller lump sums with multiple other investors, choosing specific individual properties where you are able to pick and choose to invest into each property based on which investment cases you believe will give the best return. The platform then manages both the investment process and the ongoing maintenance and administration of the property. Recent tax changes are also circumvented as the properties are owned by an incorporated company, you buy shares in the company but effectively own the same proportion of the property as shares in the company. Such a structure then avoids the restrictions on mortgage interest relieve of direct ownership of a buy-to-let property.

You do, however, sacrifice some element of control such as not being able to choose tenants or have a say in whether or not to make repairs to a property (which are usually funded by a provision deducted from the rental income).

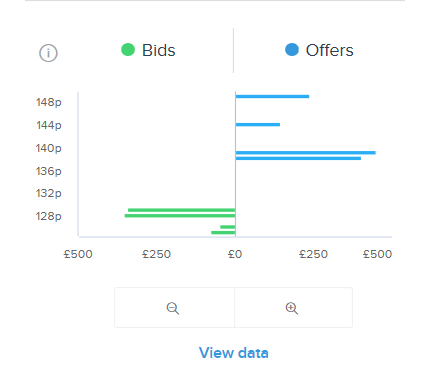

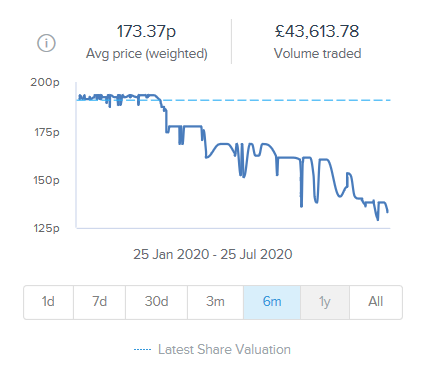

But on the plus side there are also many advantages such as it being possible to liquidate your investment much quicker than a normal property due to a secondary market that is available on the platform where fellow investors can buy your shares off you.

Property Partner provides a range of potential properties across the UK including residential houses, blocks of flats, student properties, commercial properties as well as the chance to invest in short term, hight interest development loans (typically at a rate of 10%) for property developers. It is also possible to invest via a managed investment plan which spreads your funds over multiple properties for you to spread your risk. An ISA wrapper is also available for investing into the property loans.

Whilst there are some houses on the platform, most investments available are multi-tenanted properties which I prefer as investment in such properties helps minimise the impact on income received of any tenant void periods.

Although dividends have been frozen currently due to the current uncertainty with the Covid situation (and payment holidays have also been negotiated with the banks on interest payments) dividends received typically ranged from 3% to 7%. There is then also the potential for any capital gains…

Due to being a minority shareholder unfortunately you do not get real time access to information on each property such as how finding new tenants is going etc, but the platform does provide a significant amount of information to aid your investment decisions, including:

Fees are charged by the platform along similar rates and principles to the fund management industry as follows:

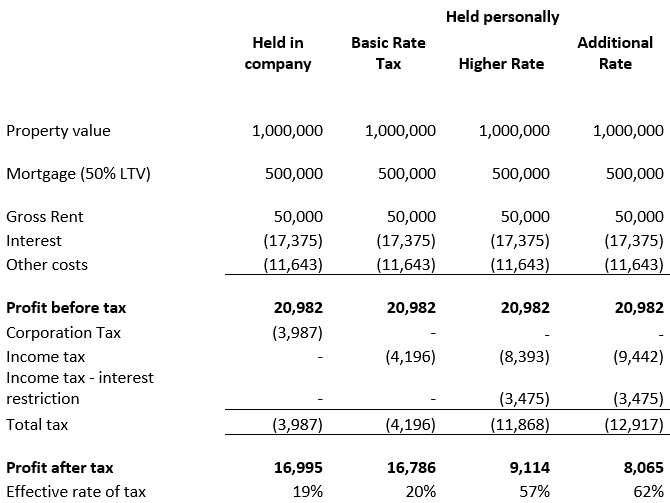

With the recent change in tax rules to disincentivise buy-to-let for higher rate taxpayers by restricting the tax deductibility of mortgage interest, buy-to-let has become somewhat less attractive. This however only impacts those people owning such properties personally. Owning the property via an incorporated company, as done through Property Partner, does not have such a restriction on the mortgage interest and so results in a significantly reduced tax burden.

To illustrate the difference in tax treatment we will take a look at an example scenario for a property valued at £1mil leveraged with a 50% mortgage and a gross rental yield of 5%:

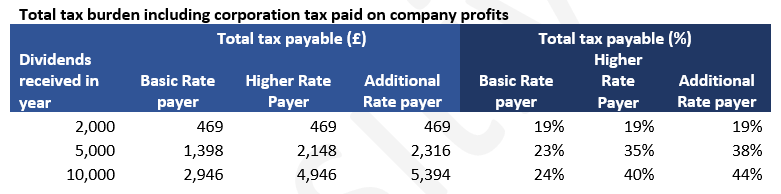

It can be seen above that a higher rate taxpayer holding a property directly would incur tax at 57%, well above the 40% income tax rate. And additional rate taxpayers would suffer tax at 62%, well up on the 45% income tax rate! Note that for the company scenario the 19% corporation tax incurred is before any profits are extracted as a dividend. We will now look at the total tax burden on any dividends paid from the company:

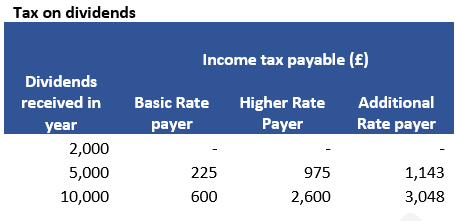

The first £2k of dividends received in a year are tax free, and then any dividends received above this incur tax at 7.5% for a basic rate taxpayer, 32.5% for a higher rate taxpayer and 32.8% for an additional rate tax payer. Therefore dividends received up to £2k incur only the corporation tax charged on the company and so effectively you receive the net rental income with tax charged at 19% whatever tax payer you are.

For dividends received of £10k, basic rate taxpayers are a little worse off than if they were to hold the property directly, incurring total tax at an effective rate of 24%. Higher rate and additional rate taxpayers, however, incur a total tax burden similar to their notional income tax rates at 40% at 44% respectively. Property Partner’s structure of investing in properties for incorporated companies therefore effectively circumvents the interest restriction rules (as well as stamp duty rules) allowing investment in properties in the most tax efficient manner.

Although Property Partner is regulated by the Financial Conduct Authority in the UK, there is no protection over your investments or uninvested funds similar to the FSCS scheme which protects your savings held with banks.

You do however own shares in a company for each property you invest in which affords you significant protection over your investments. Such a structure ring fences and protects your investments from any creditors of Property Partner as Property Partner has no ownership of the individual companies and their assets.

If Property Partner were to go bust however then it would be an unknown as to what any third party would charge to come in and manage your investments, or charge to actively sell off the properties, but presumably you would likely get most of your investment back.

Property Partnerr is great if you want to dabble in investing in property and do not have sufficient capital to invest in buy-to-let directly, or if you do have more substantial capital it is great for removing the headaches of property management whilst still having some of the excitement or thrill of directly owning a property.

It also has a very tax efficient structure compared to owning property directly and provides the opportunity to spread the risk over multiple properties, providing the opportunity to play a part in larger, multi-tenanted properties which would be unobtainable for the smaller investor.

Referral link:

If this sounds of interest then please sign up through this link: Property Partner

If within 60 days you invest: